Project | Acquisition Financing

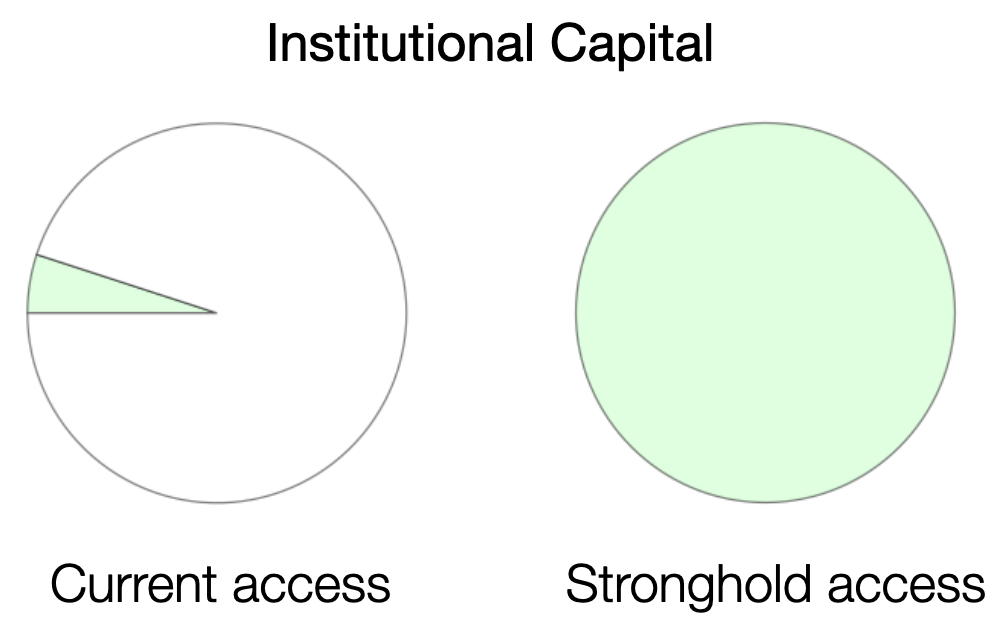

Stronghold solutions enable sponsors to access financing through Stronghold-designed programs at terms & scale otherwise unavailable.

Features

Patient capital - Programs offer deferral of interest payments which can provide up to a 3 year grace period. Deferred interest accrues to principal.

Debt financing - Stronghold has the flexibility to design investments with project and acquisition teams as debt. Programs make secured loans.

Efficient cost/use of capital - Programs can (under the right circumstances) take a mezzanine position subordinate to a commercial bank. Sponsor’s equity and Stronghold’s mezzanine debt deploy first, establishing earned value prior to accessing the commercial bank portion of a capital stack. This approach provides a highly competitive “blended rate”.

Access to larger pools of capital - Programs access the world's largest pools of institutional capital.

Real cost of financing - Programs provide a cost of financing highly competitive with conventional sources (e.g., private equity investments) and no dilution of sponsor equity..

Shariah compliant - Stronghold can cast its financing programs as Shariah compliant.

Transaction Overview

Costs

Programs have 3 sets of costs for sponsors:

1. Program design (engagement) fee:

$75,000 per $100 million of project investment

Non-refundable

Due on signing the performance investment term sheet.

2. Enhanced due diligence investigations:

Regulatory requirements of Stronghold financings require applicants to supply due diligence information and authorization of enhanced due diligence investigations on the company's management, board of directors, and major shareholders. Applicants pay the cost of these investigations (approximately BP 3,500 per individual).

3. Required return on the performance investment

Factors incorporated into required returns include:

Yields on long term sovereign debt instruments,

Required grace period,

Negotiated risk premium,

Program operational costs, and

Required returns to bond buyers.